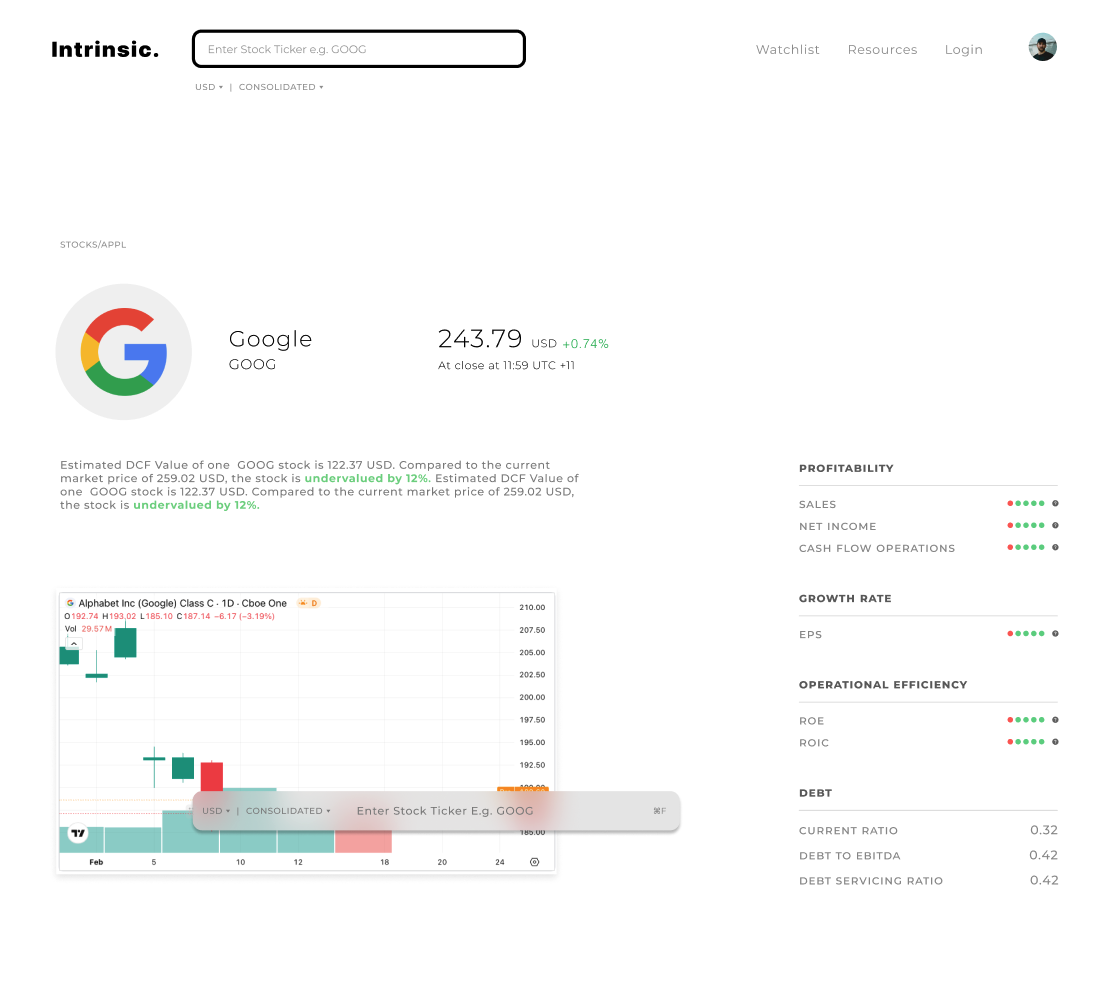

A webapp that helps users understand the calculation and intrinsic value of stocks on the US stock market.

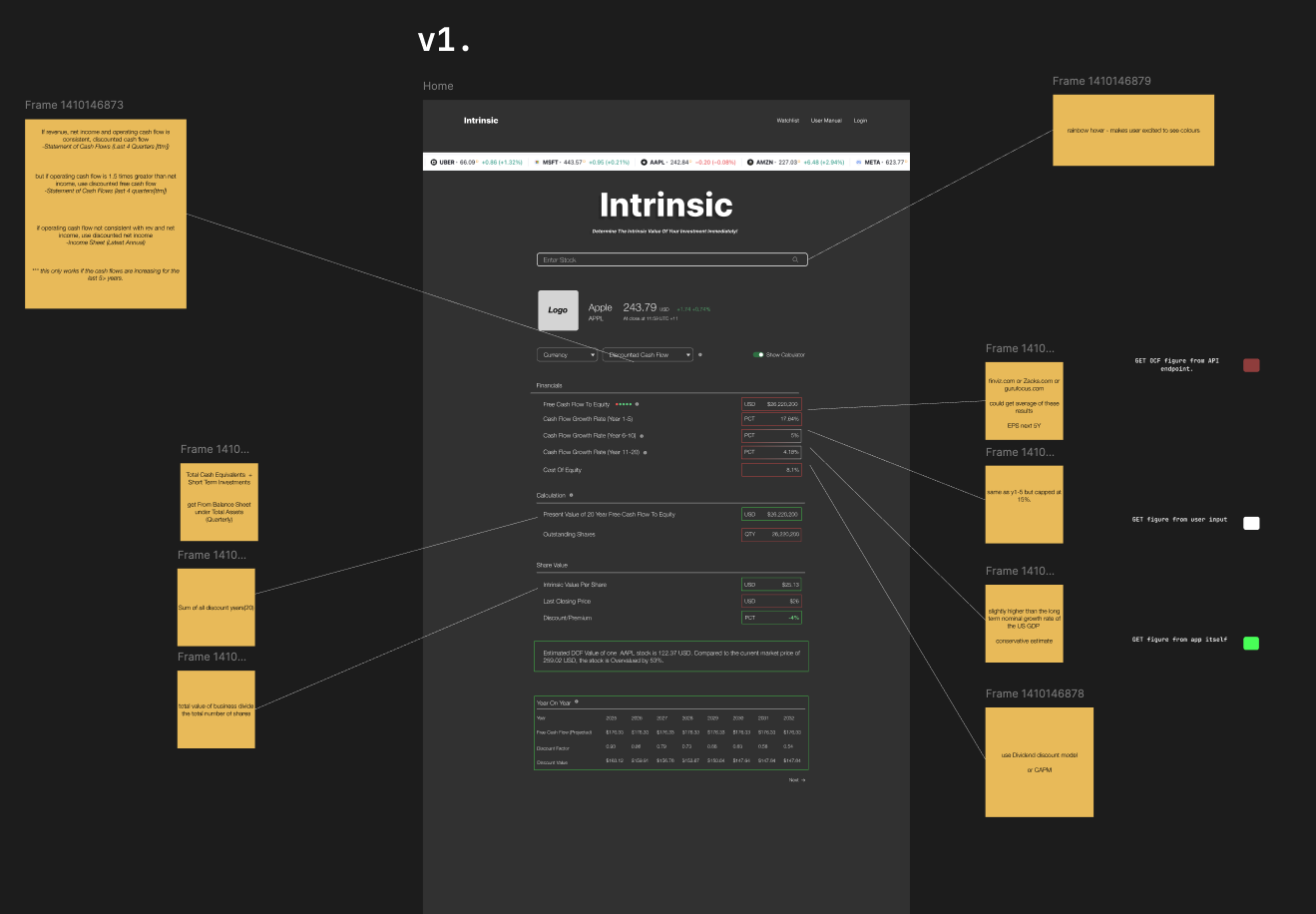

Intrinsic didn't start in a boardroom; it started as a challenge. Following a push from my boss to master React by building real-world applications, I set out to find a project that would push my technical boundaries.

Through a mutual friend, I crossed paths with Antonio Li, a finance expert with a Master’s degree and a deep specialization in stock valuation. We met up at a local kebab place downtown to talk shop, and the synergy was immediate. Tony and I realized we could bridge the gap between complex institutional finance and modern web technology. That single meeting led to an entire summer spent in my room—Tony architecting the financial logic while I translated those complex formulas into a living, breathing React application.

This project became my "deep end" for learning. While I handled the entire codebase, I was also receiving a crash course in finance from Tony, learning how to value companies while simultaneously mastering state management and component lifecycles.

At its core, Intrinsic is a comprehensive stock valuation platform that implements three distinct methodologies. When a user searches for a stock ticker, the application fetches real-time data and runs all three models simultaneously, presenting a holistic view of the company's intrinsic value.

Discounted Cash Flow (DCF) Analysis: This model projects a company's future Free Cash Flow to the Firm (FCFF) and discounts it back to present value using the Weighted Average Cost of Capital (WACC). The implementation calculates the Cost of Equity using the Capital Asset Pricing Model (CAPM).

Residual Income Valuation: This approach values a company based on its ability to generate returns above its cost of equity. The model calculates economic profit by subtracting the equity charge from net income.

Comparable Multiples Analysis: The third pillar uses relative valuation by comparing the target company against its industry peers, applying average P/E ratios to the target's earnings.

Built as a modern, performant web application leveraging the latest advancements in React and Next.js, with institutional-grade data integration.

Mastering React Through Implementation: Because this was my primary vehicle for learning React, every feature was a milestone. I had to move beyond basic tutorials to handle complex state management. With three valuation models running in parallel, ensuring that data flowed correctly from the API to the final weighted average without causing race conditions was my biggest technical hurdle.

Bridging the Domain Gap: One of the most unique challenges was the "translation" layer. Tony would explain the nuances of how professional analysts handle negative earnings or zero beta, and I would have to figure out how to represent that logic in JavaScript. I spent considerable time ensuring the code wasn't just mathematically correct, but financially sound.

Data Integrity with Financial Modeling Prep: Sourcing reliable financial data is notoriously difficult. I integrated the Financial Modeling Prep API to ensure we had access to accurate statements and real-time prices. I had to build robust error handling to manage inconsistent data formats and missing data points, ensuring the app remained stable even when specific metrics were unavailable.

The Power of "Learning by Doing": My boss was right—building a complex app like Intrinsic taught me more about React than any course could. Spending that summer coding taught me the nuances of useMemo, useCallback, and performance optimization because the financial calculations demanded it.

Collaborative Synergy: This project underscored the value of diverse expertise. Partnering with Tony allowed us to build something neither of us could have created alone. He provided the "brain" of the financial models, and I provided the "body" of the interface and logic.

Simplicity is Hard: Making something simple for the end user requires absorbing enormous complexity on the development side. Every "simple" feature—like automatically calculating cost of equity—required understanding multiple financial concepts and sourcing the right data.

Looking back, Intrinsic represents a pivotal moment in my development as a software engineer. It was a summer of intense growth, moving from a React beginner to a developer capable of building data-dense, complex applications using cutting-edge tools.